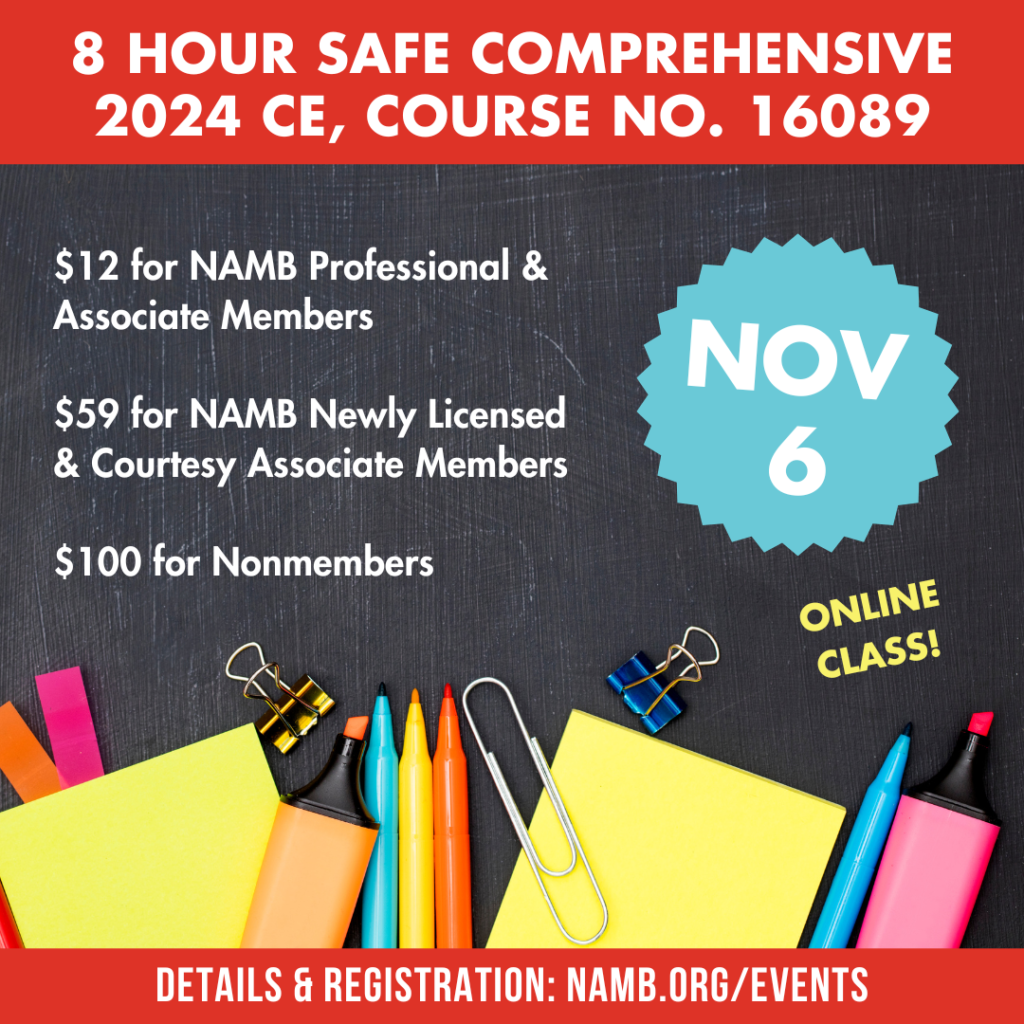

8 Hour SAFE Comprehensive 2024 CE – Course No. 16089

Nov 06, 2024 8:00AM—5:00PM

Location

Online via Zoom

Cost $12-$100

Categories continuing education, online class

Wed, Nov 6, 2024, 8am – 5pm MT

Cost: $12 for Professional and Associate Members; $59 for Professional Newly Licensed and Courtesy Associate Members and $100 for Nonmembers

This eight-hour NAMB course is designed to provide attendees with an overview of ECOA, TILA and FCRA Examination Findings; Dodd-Frank and CFPB Enforcement Actions; Anti-Money Laundering requirements and a review of Mortgage Fraud and a discussion of Affordable Housing and Non-QM Mortgages.

It allows attendees to delve into the ranked topics from 2021 3rd quarter examination reports taking into consideration the important information that every Mortgage Loan Originator must adhere to in order to prevent violations actionable by State Regulators. We also review Dodd-Frank, CFPB enforcement action trends as reflected in the Summer 2023 CFPB Supervisory Highlights Report as well as reviewing recent CFPB enforcement actions. In addition, we discuss the requirements as part of federal rules and regulations with regards to Anti-Money Laundering and look at understanding and combating mortgage fraud. Finally, an in-depth review of affordable housing in the United States as well as various affordable products plus a discussion of non-qualified mortgages including requirements and nuances. Upon completion of this class, the student will have gained knowledge and insight as to how these federal laws play a role when performing loan origination activities.